It’s been too long since posting to this blog, but as I have a break between jobs at the moment it seems like a pretty good time to give an update re developments at Montero. There’s been some evolution in Tanzania’s disputes with all three juniors, with new information coming to light that really makes clear the best course of action for the firm to achieve the biggest possible settlement or award. I’ll explain in more detail below, but in a nutshell, frustrating news of hearing date delays over the last six months (making us wait now until late November) has been far outweighed by the positive – that Winshear’s $30mm settlement in fact did not reflect collection risk from the state; that Indiana’s extreme lengths to extract its award are working; and that, as a result of both of these revelations, Montero will actually go the Indiana route to pursue their full claim, rather than settle for a quick and heavily discounted Winshear-like amount. I’m also pleased to have an activist friend onboard to defray capital allocation risk, Jeremy Raper. This means winnings will not flow back into more speculative deposits and will be returned to us as a special dividend instead. He’s also funded the company through to Q1 2025, by which point we may well be up and out of this stock given the tribunal’s decision will be due around then and Indiana’s case will have proven to the market that a large sum is indeed highly enforceable. It’s hugely positive and I’ve added shares, so let’s break it down.

Winshear News

The settlement obviously brought their dispute to an end, so newsflow has stopped, but it was revealing to find out more about their $30mm deal and why it may not entirely reflect Tanzania’s credit or collection risk, as I initially thought. Winshear’s largest shareholder, another junior called Palamina, had something of a cash crunch and was in need of funds for its own explorative ventures. Palamina was not in a position to wait and probably pushed Winshear to get a deal done, even if it wasn’t the maximum possible. It has announced Winshear’s deal to its own shareholders, which would make no sense if it wasn’t where all their funding was coming from.

Indiana News

3rd November 2023 – Tanzania Appeals Indiana Award

Turning to the case between Tanzania and Indiana, some weeks after that huge $110mm award to Indiana was handed down, we got news that Tanzania was filing for annulment (aka appealing to get the award reduced). This comes across as fairly last ditch: only something like 12% of ICSID annulment applications are successful and almost half don’t make it to the hearing because the applicant concedes.

27th December 2023 – Tanzania Submits Undertaking

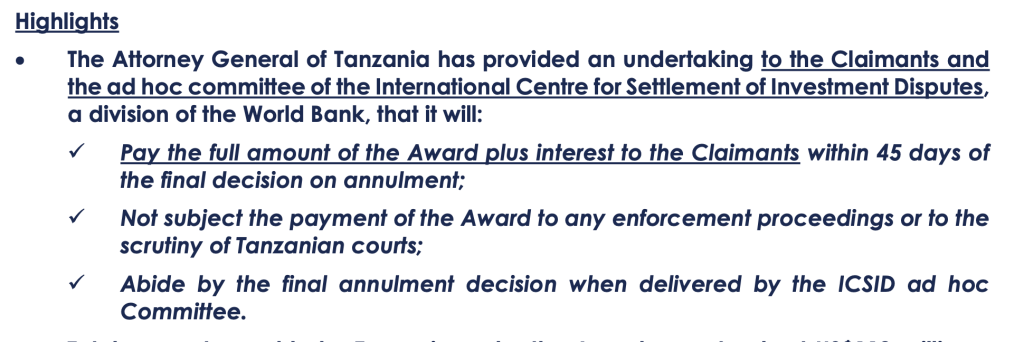

Indiana had threatened to seize assets of Tanzania, ie planes. ICSID, also keen on enforcement, then took a quite significant step to request Tanzania provide a written undertaking, i.e. make a legal commitment to pay the full $110mm+interest within 45 days or allow the asset seizures, if their annulment request fails. The state did as it was told, per the below:

In an interview with the investing media, Indiana’s CEO clearly says that if Tanzania does not pay the full sum, any Tanzanian asset in any World Bank nation (122?) can be attached. I don’t think the state can let that happen. If their annulment application fails, it will be better for them just to settle with Indiana, saying “here’s 70/80/90% of your claim upfront in cash, now leave us alone”.

7th February 2024 – Annulment Almost Dead in the Water

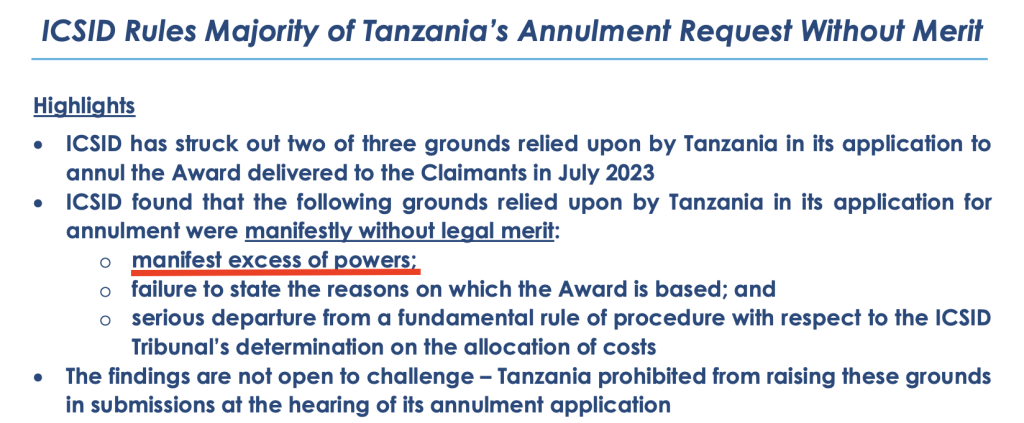

On that note, ICSID has struck down most of Tanzania’s agenda for the annulment hearing, including their argument of manifest excess of powers by the tribunal, which is the most successfully invoked annulment ground raised in 90% of all completed annulment proceedings. This means the state only has one claim left for the hearing; Ground 3, “the conduct of the tribunal.” I am not exaggerating when I say that Ground 3 refers to corruption; something that has never been successfully invoked in ICSID’s history and is deeply ironic for Tanzania to claim, all things considered. It’s also difficult to see how corruption is arguable now that ICSID has rejected the idea of manifest excess of powers. Regardless, the hearing, if we make it there, takes place on the 26th July and I am comfortable that it will fail. The ICSID Committee reading the requests said they were “extremely preliminary, lacking substance and legal basis when reviewed one by one”.

This is where Indiana sits today with Montero shareholders watching closely from the sidelines. I see four possible outcomes:

- The annulment request succeeds on Ground 3 and the entire award to Indiana is retracted (chances <1%).

You can never say never. If corruption was suspected, the entire award is getting taken away, not just some of it.

- Tanzania settles with Indiana before the annulment hearing on the 26th (10% chance).

If Tanzania were just going to settle after having most of their annulment request shot down, you feel this would have happened already in the three months since February. We’re now just one month from the hearing, though it is possible that negotiations are still taking place. If Tanzania were to settle before the 26th, it would have to do so at very close to the original award because Indiana have the undertaking. This is ideal for Indiana.

- The annulment request fails and Tanzania pays the full amount within 45 days (45% chance).

Their final hope dashed, the state should be wise enough not ignore the undertaking and threaten damage to its relationship with the World Bank. This is an equally perfect outcome.

- The annulment request fails, Tanzania frustrates Indiana as it seizes its assets and after a few months of argy bargy, Indiana accepts a lower settlement to end the dispute (45% chance).

This is, to some extent, just my conservative side taking over. But given their uncooperative behaviour since 2017 and amateur defence at ICSID, I think we really have to question the Tanzanian mindset – how far will they go to frustrate this process? It will only get them into more trouble not to honour the undertaking, eventually forcing them to settle, but Tanzania could hold out as long as possible to weaken Indiana’s resolve.

In effect then, Indiana shareholders have <1% chance of total capital impairment; around 55% chance of a tremendous outcome, receiving full compensation; and 45% chance of an OK-to-good payout that is just more laboured and volatile for the equity. This means everything to Montero, of course, as the two companies are in identical situations. If Indiana was awarded its full claim to begin with, so should Montero be. If Indiana gets an undertaking from Tanzania through an ICSID request, so should Montero. If Tanzania’s annulment request fails against Indiana, it will also against Montero. We haven’t seen it yet, but the Tanzanian payment to Indiana will be the precedent for Montero and indeed, from a rational Tanzanian perspective, when you know the outcomes, there is absolutely no point going through the entire process all over again in the vain hope of a different result. The rational version of the state could realistically settle with Montero before the first hearing.

Montero News

The above is what matters for the thesis, but there is also Montero specific news to report.

18th January 2024 – Jeremy Raper Joins the Team

Jeremy, an independent investor, originally uncovered the opportunity at Winshear and wrote about it on Twitter. I recommend giving him a follow. I was subscribed to the Raper Capital blog for 3-4 years and learnt more about investing and corporate finance than I ever would have from a textbook or academic lecture. He’s not a pundit without skin in the game. He’s a practitioner guided by an approach that has evolved with his learnings and his capital base, from investing in equities with a credit lens to event-driven investing and activism.

I was delighted to find out that Jeremy was a strategic shareholder in Montero, having bridged them through to Q1 2025. The remaining risk was that management, left to their own devices, would plough an award or settlement straight back into other resource projects, wasting it on the usual junior mining escapades. It’s essential that Montero, Jeremy and all other shareholders are financially motivated and aligned.

29th February 2024 – Dilution Calculation (a December cap raise and Jeremy’s funding)

In December, there was an initial share issuance raising $8mm to fund the company past the upcoming hearings with 5m shares sold at 15c. 1.3m further shares were granted to the Chairman, settling some debt to him and cleaning up the cap structure a bit. Jeremy’s funding was on similar terms again in a second raise; 5.4m for another $8m. There are now 44m shares outstanding, up from 33m, a 33% increase to account for.

10th June 2024 – Hearing Moved to Paris and Delayed until November

It’s important to raise this capital because it usually takes between four and six months to find out ICSID’s decision after a hearing, and Montero’s has been pushed back now for a second time. It was first pushed back from Q3 2023 to Q1 2024 because an arbitrator could not travel to the United States, and now the hearing will now take place between 19th-25th of November in Paris. You’d hope a quick decision is possible given the tribunal is considering a case which is legally identical to two recent others, but giving them a reasonable number of months, the decision could come back Q1 2025, when Montero is funded until. Montero has experienced nearly a year’s delay overall, which is really poor in my opinion, but it isn’t a huge financial concern. Given a component of Montero’s claim is the lost earned interest on Wigu Hill, which increase every month, we can look at Indiana and Winshear and see that Indiana charged Tanzania an extra $1mm per month in interest on their award, and the undertaking makes sure of that.

Upside Update for Montero

82.5% ($ claim x % payment from Tanzania x % net after litigation cut)

| Equiv to Winshear’s 33% Settlement | 50% | 60% | 70% | 80% | 90% | 100% |

| $15.2mm | $23mm | $27.6mm | $32.2mm | $36.8mm | $41.4mm | $46mm |

| 34c intrinsic value per share | 52c | 62c | 73c | 0.83 | 0.94 | 1.04 |

| 70% upside to today’s stock px of 20c | 160% | 210% | 265% | 315% | 370% | 420% |

The current stock price of 20 cents (market cap of $8.8mm CAD) is a gift. It tells us the market is only valuing Tanzania’s payment at 20% of the claim before interest, or 60% of Winshear’s settlement – way off it in my opinion. I expect the stock to double or triple in the next 6-9 months.

Leave a Reply