- Winshear settles for one-third of claim in upfront payment from Tanzania;

- Montero settlement expected earlier, upside reigned in but higher degree of confidence;

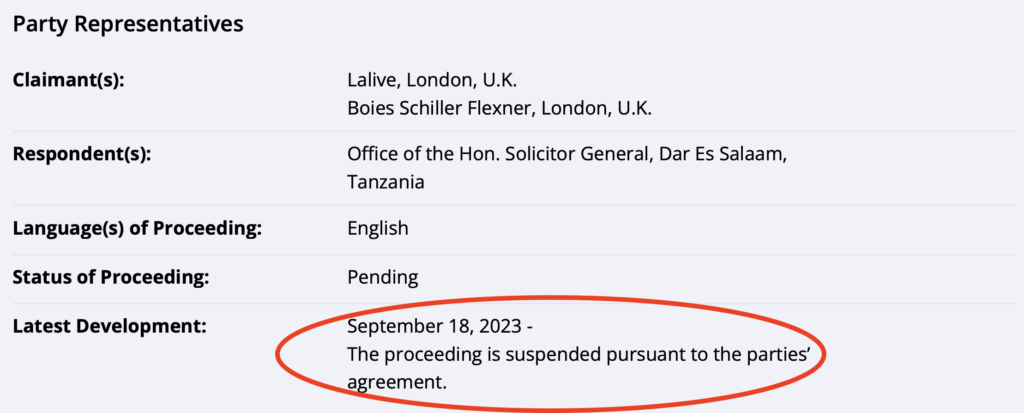

- (Montero’s case details).

ICSID flagged last month that it was suspending the Winshear-Tanzania case as both parties agreed a settlement. This news was welcomed by markets; shares rallying, before cooling off for a few weeks while we waited for a press release breaking down specifically what was agreed.

I was initially quite disappointed, to be honest, as the deal equates to the more pessimistic scenario that I laid out for Montero.

Winshear received a $30mm settlement, which, while crucially an upfront payment, represents just 33% of their claim (ref 50% was my base case for Montero; 30% the bear case). Winshear taking this deal despite having such a great claim for $90mm speaks volumes – they must see no point in waiting for ICSID to award something bigger on a ‘to be collected’ basis, as it was for Indiana, because of the inherent difficulty of collection. Indiana has gone to extreme lengths to extract its award, and if we’re honest, it does look a headache.

| Claimant | Body | Dispute | Claimant Rep | Tanzania Rep | Outcome |

| Indiana | ICSID | Retention License Tender Change, UK-BIT | LALIVE Boies Schiller Flexner | Attorney General Solicitor General | 120% of claim (unreceived) |

| Winshear | ICSID | Retention License Tender Change, BIT | LALIVE Boies Schiller Flexner | Solicitor General | 33% of claim (received) |

| Montero | ICSID | Retention License Tender Change, BIT | Jeantet AARPI Boies Schiller Flexner | Attorney General Solicitor General | Pending |

So where does this leave Montero? We wanted further precedent from Winshear’s case as to the way the dominoes would fall for Montero, and that is what we’ve got. Yes, the quantum of a winning award for Montero against Tanzania does need to be recalculated, but I believe the market has gone and rushed to judgement with the stock back in the low teens. Even basic post-Winshear math sees the setup still offer well over a double, even a triple, from our $13 basis, and the timeline for getting paid has probably been brought forward.

I argue this because if Winshear’s deal implies such terrible Tanzanian credit, why would Montero continue to incur legal costs waiting for the tribunal to award something that, according to Winshear, it can’t even collect? Even if Montero was awarded its full claim by ICSID, the market would presumably still value the award at no more than 33c on the dollar, even less if Montero hasn’t reassured the market that this money isn’t flowing straight back into exploring speculative Chilean deposits. Upon seeing the Winshear settlement, I’d rather Montero clarified its capital allocation thinking and just settled for most all compensation upfront.

In working out that deal, we would of course be looking at a much-reduced settlement amount. I’ll be direct in saying that as the collection risk implied by the Winshear deal will also be representative for Montero, crazier upside scenarios are off the table (4-5x returns). However, if this “disappointing” Winshear settlement were emulated exactly for Montero, the company would still make it out with $15mm, which equates to 40c per share on paper.

82.5% ($ claim x % as upfront settlement x % net after litigation cut) 82.5% ($90mm x 33% x 62%) = $15.2mm or .40 a share (+145%)

The Winshear agreement has not been received well with some having given up after seeing the $30mm figure, but even based on that number, Montero should not trade where it does. This chapter is far from closed and Winshear’s deal has actually made the path forward for Montero clearer, by my reckoning, so I have added to my position in the 13c-15c range. Good luck to all.

Long $MON.V and $WIN.S

Leave a Reply